Win more customers with financing

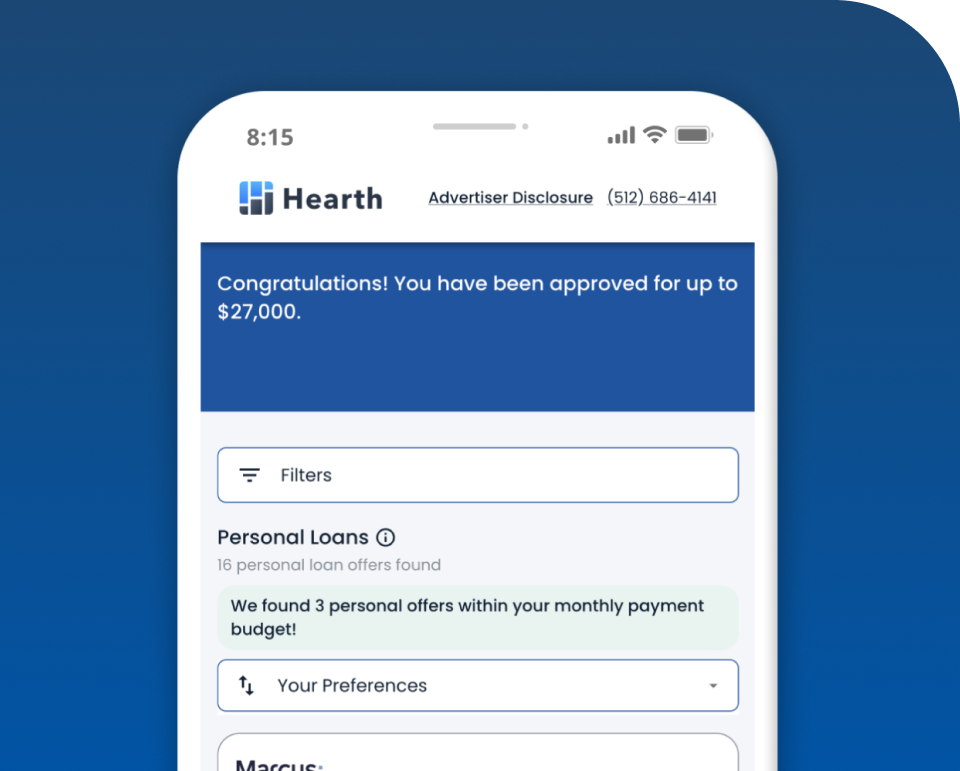

Help cash-strapped customers pay you up-front for the jobs they need

- No fees — The other guys charge 5-15%.

- 0% interest offer available — Yup.

- 17+ lenders — It's good to have options.

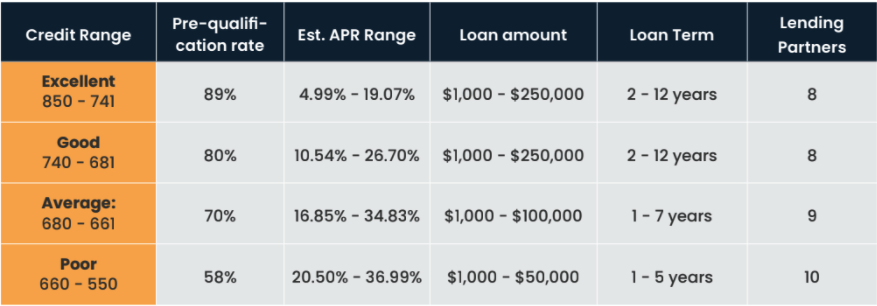

- FICOs as low as 550 — That's hard to beat.

- No liability — The lenders handle it all.

- Get paid upfront — It's business as usual on your end.

- An all-in-one tool — Integrate financing with quotes, invoices, contracts, digital payments, and more.